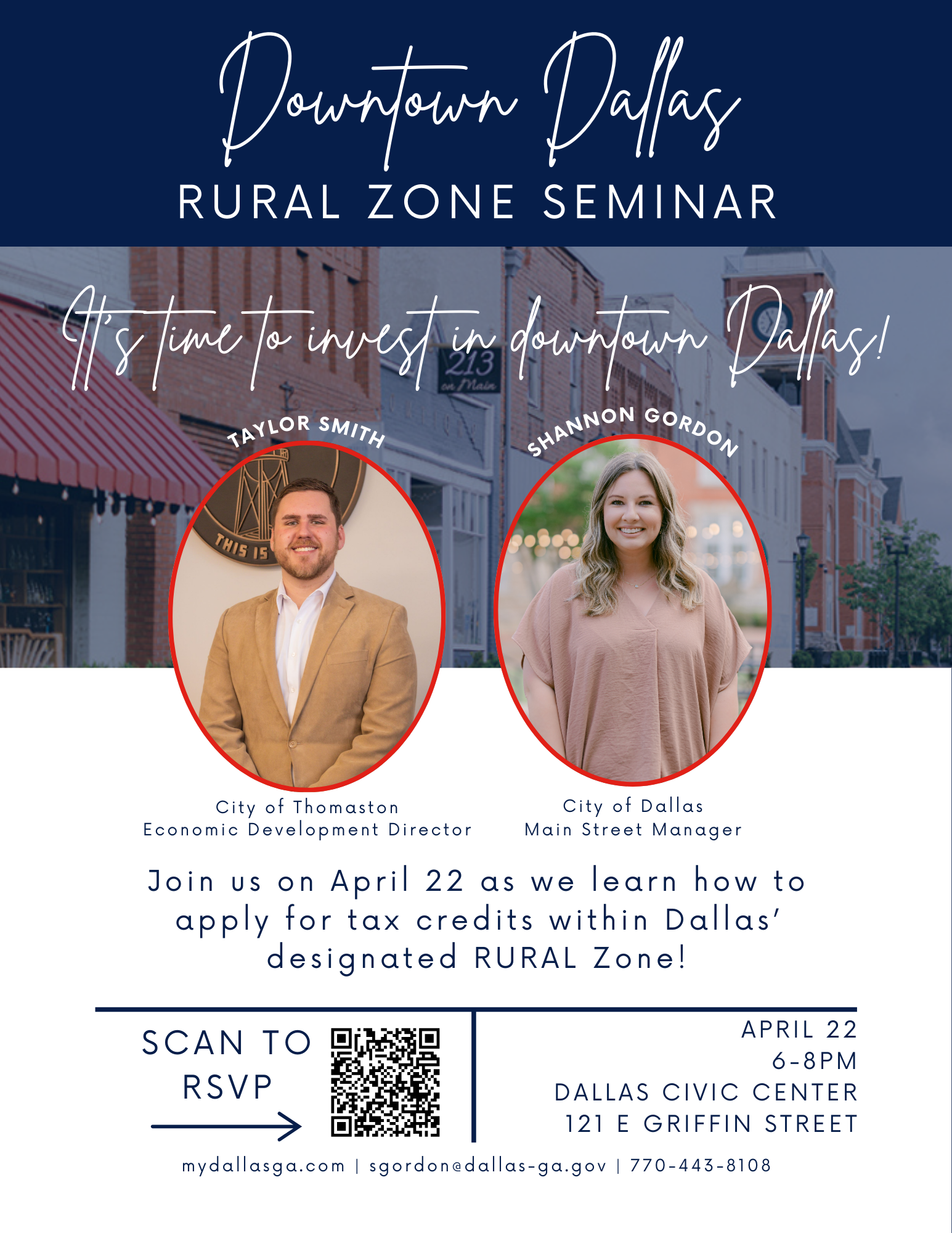

The City of Dallas is excited to announce it will be hosting a RURAL Zone Seminar on April 22, 2025, at 6:00 PM at the Civic Center, located in Downtown Dallas at 121 E Griffin Street. This seminar aims to provide valuable information to local investors, developers, and business owners about the benefits of the RURAL Zone program and how it can spur economic growth in the downtown area.

Economic Development Director Taylor Smith from Thomaston, Georgia, will speak, sharing success stories of how the RURAL Zone has helped revitalize the downtown area in Thomaston. Attendees will learn about the various tax incentives available through the Georgia Department of Community Affairs (DCA) and the Georgia Department of Economic Development, which have designated Dallas as a Rural Zone.

The RURAL Zone program, which was established by House Bill 73 in 2017, provides three significant tax credits to individuals and businesses that create jobs and make qualifying investments in designated rural downtown areas. These credits are designed to promote the rehabilitation of historic properties, spur the development of new businesses, and create jobs in communities like Dallas. The program is part of the Revitalizing Underdeveloped Rural Areas Legislation (RURAL Act), which aims to address economic distress and promote revitalization in rural downtowns.

The RURAL Zone designation lasts for five years, and activities to begin earning tax credits will officially start on January 1, 2025. As part of the program, Dallas is encouraged to develop strategies that will maximize the benefits for local businesses and investors.

To qualify for Rural Zone designation, cities must meet specific criteria, including having a population of 15,000 or fewer residents, a concentration of historic commercial structures that are at least 50 years old, and evidence of economic distress such as high poverty rates or vacant properties.

The three key state income tax incentives offered under the Rural Zone initiative are:

- Job Tax Credit: Provides $2,000 per year for each new full-time equivalent (FTE) job created within the Rural Zone for up to five years. Two FTE jobs must be created within the zone to activate eligibility.

- Investment Credit: Offers 25% of the purchase price of eligible properties within the Rural Zone, up to a maximum of $125,000. Businesses must create and maintain at least two FTE jobs to qualify for this credit.

- Rehabilitation Credit: Offers 30% of qualified rehabilitation costs (labor and materials) for the restoration of historic buildings within the Rural Zone, up to a maximum of $150,000. The credit is spread across three taxable years.

To qualify for these incentives, all projects must create jobs, and the business must maintain at least two FTE positions. For further information on how to apply for these tax credits and to determine eligibility, contact Main Street Manager Shannon Gordon at [email protected] or 770-443-8110, extension 1213.

The City of Dallas invites all interested parties to attend this seminar and learn how they can benefit from the RURAL Zone program and contribute to the revitalization of our historic downtown area.